Is TEMU the Next Amazon?

Do you ever feel like Amazon is on the verge of dominating every other e-commerce company? For years, it seemed like Amazon had no real competition, crushing any rivals that dared to challenge its dominance. But in 2023, a new player entered the market and began disrupting Amazon’s monopoly. This company created a stronger audience base, implemented more effective marketing, and attracted more daily users compared to Amazon. The company’s name is TEMU.

The Rise of TEMU

TEMU, which officially launched in the U.S. in July 2022, is a Chinese-founded company that operates primarily in the U.S. market. Its parent company, Pinduoduo, is a Chinese e-commerce giant. TEMU follows a simple business model: all products are produced or sourced in China, shipped to the U.S., and sold to American customers.

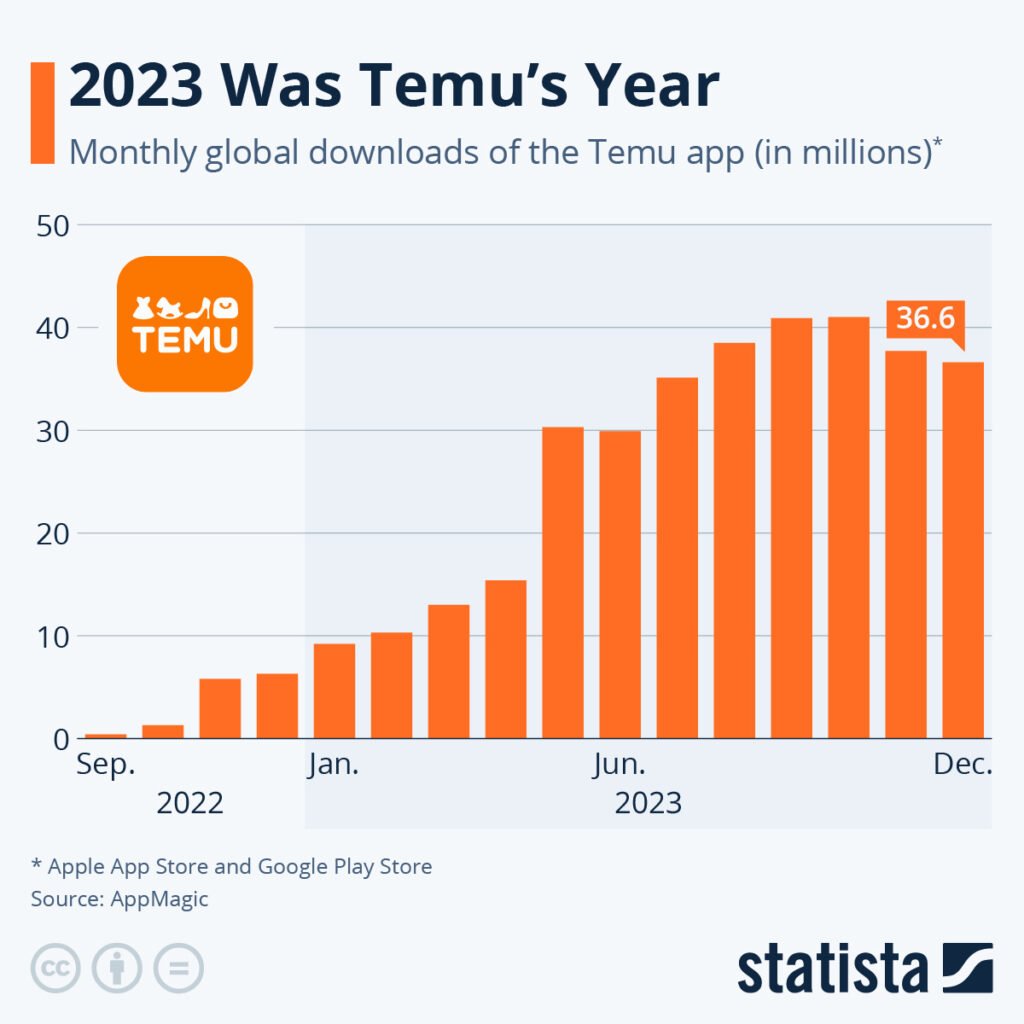

When TEMU entered the market, they already had a deep understanding of competition, pricing strategies, and customer preferences. But how did they manage to surpass e-commerce giants like Alibaba, Amazon, and Walmart in certain areas? Consider this: Amazon took almost 30 years to achieve 67 million monthly subscribers. TEMU, by contrast, managed this feat in just 12 months. Unbelievable, right?

The Secret to TEMU’s Success

Aggressive Marketing Strategies

One of TEMU’s key strategies is aggressive marketing. They spared no expense in spreading brand awareness. In 2023 alone, TEMU reportedly ran over 50,000 ad campaigns on Meta platforms, spending nearly $1.3 billion on marketing. They plan to increase this to almost $3 billion in 2024. Their return on investment (ROI) has been significant, which justifies such massive spending.

TEMU also utilizes influencer marketing through live-streaming sessions, similar to TikTok’s model. This innovative approach has gained them 161 million monthly app users. Additionally, TEMU includes gamification features in its app, allowing users to play games and win discounts or coupons. This has driven high user engagement and repeat app usage.

Competitive Pricing

TEMU offers extremely low prices compared to Amazon and other competitors. They operate on a business model that prioritizes customer acquisition over immediate profitability. Reports indicate that TEMU loses approximately $30 per order. Despite this, they continue to thrive because their parent company, Pinduoduo, subsidizes their losses.

Their pricing strategy plays on a simple marketing principle: “If the products are cheap enough, customers are willing to wait for longer delivery times.” However, TEMU has also worked to reduce delivery times significantly, filling a market gap and prompting competitors like Amazon to improve their delivery logistics.

Shorter Delivery Times

Before TEMU entered the market, e-commerce deliveries often took 10–15 days. TEMU recognized this inefficiency and reduced delivery times dramatically. By shipping over 4,000 containers in a single shipment and optimizing logistics, they managed to outpace competitors. This strategy forced even Amazon to rethink its delivery process.

Concerns and Challenges

Despite its rapid growth, TEMU has faced criticism and skepticism:

- Loss Per Order: Losing $30 per order raises questions about long-term sustainability. TEMU’s survival currently depends on its parent company’s financial support. If Pinduoduo stops subsidizing these losses, TEMU will face significant challenges.

- Product Quality: Many customers have complained about receiving low-quality products. No matter how cheap the price, dissatisfied customers could jeopardize TEMU’s reputation and growth.

- Geopolitical Issues: TEMU’s position as a Chinese company operating in the U.S. comes with challenges, especially given the tense relations between the two countries. The situation could worsen if trade restrictions or bans are imposed, as seen with TikTok in India.

- Future in India: India represents a massive market for e-commerce, but Chinese companies face strict scrutiny there. Whether TEMU can enter and thrive in the Indian market remains uncertain.

Is TEMU a Scam?

With its rapid rise, some have questioned TEMU’s legitimacy, labeling it a potential scam. However, TEMU’s operations are backed by Pinduoduo, a well-established corporation. This support has allowed TEMU to grow at an astonishing rate. The real question is whether TEMU can maintain its momentum and profitability once subsidies decrease or operational costs rise.

Will TEMU Be Sustainable?

TEMU’s sustainability depends on several factors:

- Maintaining customer trust by improving product quality.

- Balancing aggressive pricing with profitability.

- Navigating geopolitical challenges in its key markets.

According to business analysts, if TEMU fails to address its quality issues and customer satisfaction, even its aggressive pricing strategy will not save it. Sustainability will also hinge on whether it can diversify and expand into other markets, such as India, without significant backlash.

Conclusion

TEMU’s meteoric rise has undoubtedly shaken up the e-commerce industry. Whether it will continue to grow or falter remains to be seen. What do you think about TEMU? Could it truly become the next Amazon, or is its business model destined to collapse? Let us know your thoughts in the comments below!

Thank you for reading! If you notice any inaccuracies or have additional insights, feel free to message us. Stay tuned for more updates. 🙂